Service is bad at the best of times. Bad news: it's about to get much much worse. Why?

The internet.

The internet is migrating all of the services we once had to travel somewhere to use. You want to buy clothes? No need to ask you helpful sales assistant about their latest special offers. Just point and click.

But what becomes of the helpful sales assistant? Well, the first thing is, they become a whole lot less helpful. They get trained less and, worse, less motivated to compete with their dot.com colleague.

***********************

While human sales assistants are a dying breed, it's the services industry that has been the main driver of economic growth for a large number of the major advanced economies in recent decades.

If a significant (and in recent years, growing) part of the workforce that lies behind a growing economy deteriorates on a mass scale then it signals a major deterioration in a large proportion of the labor force.

Ultimately, it will be the frustration of shoppers in department stores and people on line in Starbucks that will accelerate the complete migration of shoppers from the high street to the internet.

***********************

As with all social change, a lot of the change can only be brought about by social forces moving in the direction of that change. The ever-more sloppy sales assistant may well be the last straw.

Or they could just stand up straight, look fast and pretend to be professional!

**Afterthought**

All of this clearly begs the question, what becomes of all these sales people? This also raises the issue of what to do with all space currently taken by retail outlets.

One possible scenario would be for these buildings to become residential. This would help provide homes where they are most needed: in the inner cities. This might help initiate a new industrial architectural revolution. Such a revolution would resuscitate the manufacturing industry, bringing full circle the changes seen in the 20th century.

Perhaps the hands that serve us in the stores will be those helping to build the homes of the future in the not-too-distant future.

Monday, February 28, 2005

Thursday, February 17, 2005

Goodbye Greenspan, hello inflation target?

In June last year, I explained why the bond market was important.

I'm back to explain why again and also predict what will happen to U.S. interest rates after Alan Greenspan retires from the best job on earth.

********************

In case you hadn't already noticed it's daily movements in the bond market that actually determine the mortgage rates your bank offers you on a daily basis.

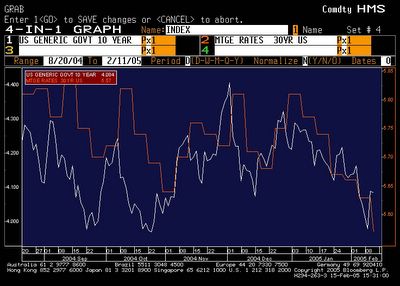

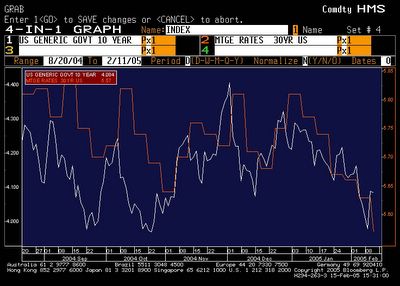

If you don't believe me, look at the chart below that shows the 10-year government bond yield (set by the bond market every day) against the 30-year mortgage rate (set by the banks every day).

(Red: 30-year mortgage rate. White: 10-year bond yield)

Most people might think it's the central bank who directly (or even indirectly) set mortgage rates, with retail banks following suit. This isn't how it works.

Firstly, central banks only change interest rates on a monthly basis, if at all. However, banks change the rates they offer to lenders all the time. You might wonder how they can do this if the central bank hasn't changed the "interest rate".

The reason is simple: banks settle their books at the end of every working day by borrowing money at a rate of interest that is being set by the bond market. The bond market sets the interest rate according to expectations of future inflation.

If inflation is expected to increase then interest rates will have to rise in order to compensate bondholders who will see the value of their investment fall in real terms.

********************

As I also mentioned before, the past 2 decades has seen a major crackdown on inflation. This has meant lower interest rates across many countries.

The U.S. is one of the few countries that does not directly target the inflation rate, simply because the person in charge of monetary policy does not want to use a target.

Since Alan Greenspan is expected to leave his post in the near future this raises the possibility that the Federal Reserve will adopt an inflation target as well. This will be very good news for the bond market and more importantly, great news for mortgage holders.

An inflation target means the bond market expects low inflation. Low inflation expectations means low bond market yields. Low bond market yields means low overnight interest rates and this means low mortgage rates.

3 cheers for Alan Greenspan. More cheers for the inflation target!

I'm back to explain why again and also predict what will happen to U.S. interest rates after Alan Greenspan retires from the best job on earth.

********************

In case you hadn't already noticed it's daily movements in the bond market that actually determine the mortgage rates your bank offers you on a daily basis.

If you don't believe me, look at the chart below that shows the 10-year government bond yield (set by the bond market every day) against the 30-year mortgage rate (set by the banks every day).

(Red: 30-year mortgage rate. White: 10-year bond yield)

Most people might think it's the central bank who directly (or even indirectly) set mortgage rates, with retail banks following suit. This isn't how it works.

Firstly, central banks only change interest rates on a monthly basis, if at all. However, banks change the rates they offer to lenders all the time. You might wonder how they can do this if the central bank hasn't changed the "interest rate".

The reason is simple: banks settle their books at the end of every working day by borrowing money at a rate of interest that is being set by the bond market. The bond market sets the interest rate according to expectations of future inflation.

If inflation is expected to increase then interest rates will have to rise in order to compensate bondholders who will see the value of their investment fall in real terms.

********************

As I also mentioned before, the past 2 decades has seen a major crackdown on inflation. This has meant lower interest rates across many countries.

The U.S. is one of the few countries that does not directly target the inflation rate, simply because the person in charge of monetary policy does not want to use a target.

Since Alan Greenspan is expected to leave his post in the near future this raises the possibility that the Federal Reserve will adopt an inflation target as well. This will be very good news for the bond market and more importantly, great news for mortgage holders.

An inflation target means the bond market expects low inflation. Low inflation expectations means low bond market yields. Low bond market yields means low overnight interest rates and this means low mortgage rates.

3 cheers for Alan Greenspan. More cheers for the inflation target!

Friday, February 11, 2005

Tax rant cont.

Three things are certain: death, taxes and more taxes.

The closer you get to death the more in taxes you are going to pay.

As I outlined before, if your income doubles you are going to pay about double the amount of tax.

This is the society's definition of fair since taxes act to redistribute money from one group of society to another; i.e. from the rich to the poor.

*********************

As I also outlined before, America has a major problem with saving. The government and the citizens it represents don't like doing it.

If an individual is short of savings they go to a bank to borrow money.

The government goes to the public, by way of taxation. The more money the government needs, the higher taxes go.

The problem facing the U.S. government is an increasing need to fund expenditure by way of taxation. This means taxes will need to rise further.

*********************

A commonly heard argument is that people with higher incomes (let's call them 'companies') should be taxed more than those with lower incomes.

This is considered a fairer way to raise the extra money the government needs.

However, since it's companies that hire people on lower incomes, then taxing the rich indirectly taxes the poor.

A company that loses a higher share of it's income to the government will have less left over to hire more people.

You can only go to the well so many times before it eventually runs dry.

*********************

The economy runs in a circle: companies make things, people work for companies, people spend money on things companies make.

If one part of this cycle is taxed more than another then it takes away from all other parts as well.

If the government needs to raise more money by increasing taxes it does not benefit any part of society by focusing those increases on certain groups.

**Afterthought**

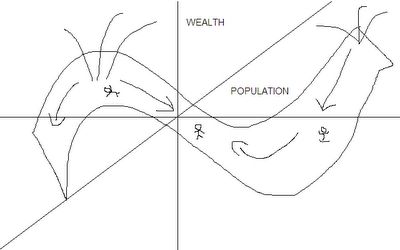

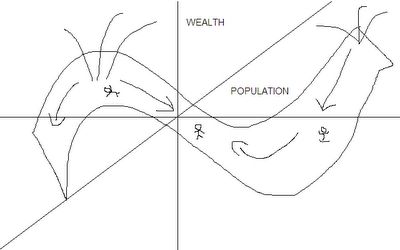

In light of the comments to this blog, perhpas this is the best 3D representation of how wealth is distributed amongst various groupings of the economy..

The closer you get to death the more in taxes you are going to pay.

As I outlined before, if your income doubles you are going to pay about double the amount of tax.

This is the society's definition of fair since taxes act to redistribute money from one group of society to another; i.e. from the rich to the poor.

*********************

As I also outlined before, America has a major problem with saving. The government and the citizens it represents don't like doing it.

If an individual is short of savings they go to a bank to borrow money.

The government goes to the public, by way of taxation. The more money the government needs, the higher taxes go.

The problem facing the U.S. government is an increasing need to fund expenditure by way of taxation. This means taxes will need to rise further.

*********************

A commonly heard argument is that people with higher incomes (let's call them 'companies') should be taxed more than those with lower incomes.

This is considered a fairer way to raise the extra money the government needs.

However, since it's companies that hire people on lower incomes, then taxing the rich indirectly taxes the poor.

A company that loses a higher share of it's income to the government will have less left over to hire more people.

You can only go to the well so many times before it eventually runs dry.

*********************

The economy runs in a circle: companies make things, people work for companies, people spend money on things companies make.

If one part of this cycle is taxed more than another then it takes away from all other parts as well.

If the government needs to raise more money by increasing taxes it does not benefit any part of society by focusing those increases on certain groups.

**Afterthought**

In light of the comments to this blog, perhpas this is the best 3D representation of how wealth is distributed amongst various groupings of the economy..

Subscribe to:

Posts (Atom)