Wednesday, October 17, 2007

Manias, Panics and Greenspan

1) buy it;

2) buy it on Amazon.com;

3) also buy a copy of Manias, Panics, and Crashes: A History of Financial Crises;

thereby:

1) greatly improving your understanding of how policymakers react to economic and financial market volatility;

2) saving you some money;

3) suggesting to other people that they buy the same combination, potentially enhancing their (and your) understanding of how financial markets behave.

Reading both books will help sharpen your understanding of how financial markets and economic policy interact, helping to ensure you make more money when others are struggling to stay afloat or worse, living in fear of losing money of their own.

Luckily for you, the key messages contained within both of these books are summarised below.

For those of you with enough time to get through both books, you can stop reading here and go buy them now.

********************************

Memoirs often give famous people the first chance in their life to "come clean", revealing facts and tidbits that had until then remained a secret.

The first half of Alan Greenspan's "The Age of Turbulence" provides an unusual amount of information that was for the most part deliberately kept from the public during a period of almost 20 years.

One of the most important confessions that Greenpan makes about many of the issues he was presumed to be all-knowing is this:

"I really had no idea."

While Greenspan would (understandably) have been extremely reluctant to make this statement while Fed Chairman, he is now all too willing to reveal many of his inadequacies.

And even though we are being told this "after the event", much of what Greenspan says offer important insights into the way his successor, Ben Bernanke, is likely to be thinking about approaching the current turmoil in the financial markets.

A good example of Greenspan in honest, frank talk-mode, comes on page 156:

"Knowing when to start tightening [monetary policy], and by how much, and most important, when to stop was a fascinating and sometimes nerve-racking intellectual challenge... it didn't feel like "Oh, let's execute a soft landing", it felt more like "Let's jump out of this sixty-story building and try to land on our feet.""

Note these remarks were made in the context of the challenges facing the Fed during 1996, when the economy was cruising along nicely. During periods of financial market crisis, this uncertainty balloons. Being able to understand the mentality of policymakers in these circumstances is critical to formulating an investment strategy at such times.

And remember, the implications for monetary policy in reaction to certain events in the financial markets can be as important as the events themselves.

********************************

Greenspan's tenure at the Fed was marked by two distinct events, seperated by almost exactly 10 years: the 1987 stock market crash and the Asian/Russian financial crises of 1997/8.

Both of these events, as catalogued by Greenspan, both tell a story of a severe shock to the financial system coming at a time of a resilient economic expansion.

As a result, the emergency easing of monetary policy on both occassions were enough to prevent a pronounced and pervasive problem from becoming persistent. As Greenspan reflects on page 191, about the period following the Russian default in 1998:

"[the fear was growing that] after seven spectacular years... the US economic boom was coming to an end. That fear, it turned out, was premature. Once we coped with the Russian crisis, the boom would continue for another two years, until late 2000, when the business cycle finally turned."

A decade earlier, Greenspan, in his first year as Chairman, faced the biggest one-day loss ever in the stock market (-22.5%). But, as he reflects on page 110:

"Contrary to everyone's fears, the economy held firm, actually growing at a 2 percent annual rate in the first quarter of 1988 and at an accelerated 5 percent rate in the second quarter."

Two years later the cycle finally turned.

********************************

Two things should stick out a mile:

1) financial crises occur with odd regularity;

2) these crises occur at the late (though not final) stage of the economic cycle.

What's all that about then?

Well, this is what brings me to suggest reading Manias, Panics, and Crashes in conjunction with Greenspan's memoirs.

Manias makes two key observations:

1) economic theory is incomplete and thus incapable of explaining what, why and how financial crises occur;

2) all financial market crises are similar to each other.

While 1) is more of an academic point, 2) isn't. Not only is it consistent with the pattern of many historical crises of both the 19th and 20th centuries, it also makes perfect sense. As the economic cycle matures, much of what caused asset prices (i.e. equities) to rise will inevitably reach a point of saturation or obsolescence, bringing with it a costly transition to the "next phase" of the economic cycle.

This should also suggest the following likely scenario after the financial market crisis we have just witnessed this past summer:

1) The Fed will continue to provide additional liquity to the markets, thus avoiding any sustained downturn in the stock market;

2) the economic cycle will turn in 2 years;

3) at that point, there is little the Fed can do to prevent the stock market from falling, which it will likely do in an orderly fashion.

4) Ben Bernanke will start taking a bath each morning from now on.

Thursday, October 04, 2007

A winning political slogan

Unfortunately, most people see it for what it really is: a desperate bid for power.

This is why more people will continue to stay at home instead of going to the polling stations to vote.

And they'll remain there until there is a true revolution in the way politics 'works'.

********************************

The coming weeks will probably bring with it the opportunity for British people to choose the political party of their choice.

But what choice are they being offered?

Over the past couple of weeks, both Gordon Brown and David Cameron had the opportunity to set out their respective visions for the future of Britain.

As you would expect, both men made a very compelling presentation.

Cameron managed to set out the Conservative Party's case in a most eloquent (and even unscripted) way at Blackpool this week. What his argument boils down to is this:

'Vote for the Conservative Party so we can correct the mistakes that the Labour Party made after correcting the mistakes that the Conservative Party made before them!'

However much he glosses over it, it is this message which gets through loud and clear to me as a (potential) voter.

To get me to vote, not to mention actually getting my vote, what he should have said was this.

'Vote for me so that I can quit and then transfer the power back to you.'

The choice this presents to Cameron is exactly what he offers to us: none at all.

He has no interest in giving decision-making powers back to the people and we have no interest in giving it to him.

And around and around it will go, as an ever smaller proportion of the voting population will decide who governs over the rest of us.

Eventually something will be done by someone with enough vision to make a real change, but the chances of that happening in our lifetime are extremely remote.

********************************

Politicians are very smart people. They can absorb an enourmous amount of information, have excellent communication skills and make fantastic presentations.

Why not harness all of these skills and remove the powers they have to make decisions on our behalf?

I believe that the best role a politician can play is as a consultant to the people.

If a new law or budget is required to deal with a social problem or to build a new school, have politicans consult with people about the options available and have the public decide on which course of action to take.

This is politics that engages the public and gives the power back to them.

I'd vote for that. Wouldn't you?

Monday, September 17, 2007

Sale still on!

All the scenes of panic in the UK high street will have given the public a first-hand view of a bank run.

At the same time, there is a lot of debate about whether or not the US economy will fall into a recession and what this might mean for the rest of the world.

It is tempting to think it will get much much worse before it gets any better.

*************************

While the bad news is far from over, it would be premature at this stage to conclude that a US recession is inevitable.

But this is exactly what financial markets all over the world did in August.

Trillions of dollars were wiped off the value of financial assets on speculation that companies around the world would report weaker earnings and the world economy would stagnate.

Well it hasn't, yet. And whether it will be as bad as some would have us believe is still an open question.

What this experience should teach anyone who is actively investing their own money in the financial markets (myself included) is that the underlying strength of the global economy is what determines whether financial markets are likely to perform well or not, and not the other way around.

*************************

In other words, when stock markets sell off out of blind panic (as they did in August), but the underlying economic data remains strong, this should present an opportunity to any investor; rather like buying clothes on sale.

And the sale is still on! The same jumper that looked a bargain a few weeks ago is still a bargain today.

But at some point the current stock will go bad and won't be as good a bargain as before.

When a US recession becomes unavoidable, it will be time to shop elsewhere. Government bonds will be all the rage then.

Watch this space!

Wednesday, August 15, 2007

Misleading hindsight

One unfortunate aspect of the latest rout is that most experts don't seem to know how much further markets are likely to fall.

This puts not just experts, but people who rely on experts (e.g. investors), in an extremely awkward situation. Without any conviction on which way to trade, markets can at best go sideways or at worst come crashing down.

In reality, we're simpy in the midst of something the world has witnessed ever since the dawn of time: an extremely rare and unexpected event with an uncertain outcome.

While we usually get to hear about why a major event such as this occured after it occured, we now have the rare opportunity to witness how truly limited our understanding of uncertainty in financial markets has remained despite all of the advances in mathematical modelling and trading strategies.

******************************

There's nothing new about a lurch downwards in markets, otherwise known as "corrections". They usually occur as the result of a market being "overbought", which then leads to an inevitable decline (usually around 10%) and a subsequent "bounce".

At the moment, the exact cause of the downturn is not fully understood, so making a prediction about when and how much of a bounce is likely, is more uncertain than usual.

One explanation doing the rounds is that market participants have failed to learn that they fail to learn, otherwise known as a "black swan" event. This describes how after something completely unexpected happens, we come up with an explanation that attempts to explain exactly what happened and why it was predictable after all, thus creating a false sense of certainty about future uncertainty.

This problem is compounded by people attempting to draw analogies with past events to try and guage how much worse it might get. This effectively uses a backward-looking explanation of the past to help predict what might happen in the future!

If you were to suggest, based on your experiences at the time, that the current episode is similar to the events of October 1987, most people who work in the financial industry would have to take you at your word, since they are unlikely to have been working (alive??) at the time!

The more recent the period with which you make the comparison the more people you are likely to convince. In the end, there is a story to satisfy everyone. However, every story will have one thing in common: a misleading reference to the past in an attempt the predict the future.

******************************

We are at one of those rare times when an expert will tell you exactly what they have always known about the future: very little.

At the end of the day all you can know is what you know. While it may not always be possible to know why something is happening, it is possible to guage the ability of the global economy to weather the storms that come along.

At the moment markets are falling while the global economy is resilient. If the environment were less bouyant than at present then the current turbulence in financial markets would have much wider ramifications than they currently do.

In the meantime all we can do is sit tight and hope for the best!

Sunday, August 05, 2007

If...

This is unfortunate, since there's one poem that contains a lot of helpful advice for those who have been in the red these past few weeks.

The English writer, Rudyard Kipling wrote a famous poem in 1910 entitled, If. It opens:

"If you can keep your head when all about you are losing theirs..."

In the financial world this could be taken as meaning:

"A contrarian investor has much to gain". Or more concisely:

"Buy low, sell high".

But there is also a deeper message. It stresses the importance of self-belief and, more importantly, scepticism towards what other people are saying.

If you take any message from this poem, it should be that while sometimes you may be right and sometimes you may be wrong, if you stop believing in yourself, you might as will give up and go home.

*************************

The past two weeks have seen significant losses across equity markets around the world. At the same time there is a belief among many that not only was it coming, but it's only just begun.

If you stop and consider this for a moment you realise that anything anyone says about the financial markets will always have an implicit bias.

Anyone with an opinion about financial markets either has money, their reputation or both at stake. If someone had expected markets to fall then they are likely to say the markets have further to fall. If they hadn't expected markets to fall, they probably won't expect them to fall much further.

Who should you believe?

The first point to make is that until now a lot of people had been expecting a "correction" in the markets "at some point", so the appearance of such a move is proof to many that not only were they right, but they were right when others had not believed them. This "pride" effect takes time to subside and since pride is always expressed loudly, it tends to find its way into the mainstream media faster than Paris Hilton on her way to jail.

Then there are those who didn't expect it to happen and weren't prepared for the consequences. These people are more in shock than anything else and will be pretty much useless for providing advice until things recover completely, which could take days, weeks or months.

Finally, there are the select few who saw it coming a mile away. They knew exactly when a significant selloff would take place and positioned themselves accordingly. Unfortunately, these people rarely express their thoughts in public. Think about it, if you knew when panic would strike markets and everyone would rush for the exits at the same time, would you advertise that fact? Unlikely.

In reality, the only person whose judgement we can truly rely upon is our own. Today's winner is likely to be tomorrow's loser.

*************************

"If you can make one heap of all your winnings and risk it on one turn of pitch-and-toss, and lose, and start again at your beginnings and never breathe a word about your loss..."

Never breathe a word about your loss. In other words: a loser never says when they losing while a winner usually tells you when when they're winning!

Everyone is wrong some of the time, so when they're right and they let you know this, be wary of not only what they are telling you, but why as well.

Friday, July 20, 2007

America awakes from its dream

But this is not for the reason you might think (I'll leave that thought with you!).

The main reason why I believe no American would want to travel abroad this summer is because the value of the US dollar is close to the weakest it has ever been.

As I wrote over two years ago there is good reason to expect the dollar to fall further in value in coming years.

As always, people have two questions about the dollar: how much further can it fall and what does this mean for the rest of the world?

In short, it will keep falling as the Chinese yuan continues to strengthen (and when that will stop nobody knows). And it's not so much what it will mean for the rest of the world but what the rest of the world will mean for the dollar.

If there is a further diminishing appetite for US dollars by countries including China and Japan, then the dollar could fall even more rapidly, sparking a sell-off in US assets and a major crisis across global markets (fingers crossed that won't happen!).

In any case, there is the potential for people to make a LOT of money from the dollar's decline. After all, if you're going to bet, bet big.

**********************

I made two predictions in 2005, one that turned out to be right and the other one that is turning out to be right.

The best prediction I made was to expect the British Pound to strengthen, thus providing a "safe haven" against the likely decline in the dollar.

Up, Up & Away!

Since mid-2005, the Pound has strengthened by almost 20% against the dollar as money has flown to the high yield of British assets (bonds, real estate etc.). Over the same period the FTSE 100 share index has also gained over 30%.

So for investors who had to choose between markets around the world, owning UK shares in Pounds would have been a very wise move (Britsh people have just had to sit back and watch the money roll in... and out to the high street!). For now, this looks like a good strategy to continue for the rest of the year.

**********************

A forecast I made that is beginning to prove correct is a more rapid decline in the dollar overall.

Calm before the storm?

After I predicted a more rapid decline in the dollar in 2005, exactly the opposite proceeded to happen (perhaps some very influential contrarian investors read my blog after all!). For the first year since 2000, the dollar strengthened against the major currencies of the world.

But like most forecasts that are grounded in basic common sense, eventually it prevails and now marks the point where reality begins to "kick in".

Unfortunately, a decline in the dollar is a double-edged sword.

First is the obvious diminished purchasing power of American consumers. The second relates to China.

There has been a lot of pressure on China to strengthen the yuan. While this has happened, albeit gradually, it has come at a time when the dollar has weakened. And since the yuan is still partly pegged to the dollar, the Chinese currency has reflected this weakness, offsetting part of the strength.

So, if the dollar continues to weaken then not only will it hurt the purse of American consumers, US producers will also lose competitiveness to Chinese manufacturers. That's not to mention the fact that a weaker dollar reduces the value of US assets currently held by the Chinese government in the form of US government bonds, which adds to the incentive for the Chinese to diversify into other currencies (British pounds perhaps??). Either way, this does not bode well for the US dollar at all.

**********************

It is not the best time to be an American citizen.

Apart from a deteriorating reputation their country has in certain regions of the world (not mentioning any names!), the value of their home is likely to be flat or declining and they can't afford to go shopping for clothes in Europe.

At some point things will improve but at the moment it's difficult to see this happening any time soon.

Friday, June 15, 2007

Learning from the past

As I mentioned before, economists need to make assumptions about the future in order to forecast.

Unfortunately, these assumptions tend to be wrong, as do their forecasts, which is why forecasts tend to be revised on a regular basis.

But I've come to realise that bad forecasting is also the result of looking at what happened in the past and failing to learn from it in a way that will help and not hinder predicting what could happen in the future.

While we are used to hearing that "the past is no indication of future performance", it is still possible to glean from past data critical information that will help in making a forecast more accurate and less prone to revisions.

Economists fail to take away the right information from past observations and keep making the same mistakes over and over again.

*********************

So, how can the past help us to predict the future? It depends on how you look at what happened.

Imagine you travelled down a road at 8am and it becomes very heavily congested. Based on what you have observed, you might also expect that if you travel down the same road tomorrow at 11am then it will be congested again.

Of course, this fails to take account of the fact that before 9am the road is unusually congested, since it's in the middle of the rush hour.

Economists make a similar mistake when using past observations to help forecast the future path of the economy.

They tend to look back at what actually happened rather than at what caused it to happen. In other words, economists look back at backward-looking data to help predict the future!

*********************

In trying to predict a recession it would be better to look at what leading indicators were doing in the run up to previous recessions and compare this to what they are doing now.

Instead, economists look at what happened to GDP, unemployment and inflation, which give no indication about the future, to predict what will happen to GDP, unemployment and inflation!

Part of the reason why economists don't use leading indicators is because they don't trust their accuracy. Currently, the OECD and Conference Board produce the most widely-followed leading indexes but these have had a poor record at predicting recessions.

Another reason why economists are sceptical about leading indexes is because they don't fully understand how to accurately construct one of their own.

A lot of work has been done in this area by my former employers at ECRI and you can follow some of their leading indexes in the press. However, since they are a private firm only a small amount of information is made public. This is unfortunate, since they have a pretty decent record at predicting turning points and in particular, the timing of recessions.

*********************

The fact that economists make bad forecasts is not necessarily a problem (they can be useful in other ways too!). However, financial markets look to economists, either in the private sector, government or at central banks to guide expecations about the future. If these expecations prove to be inaccurate or plain wrong then stock and bond markets will be unecessarily volatile. In reality, this is what we observe.

Trying to understand what caused something to happen in the past can help predict what is likely to happen in the future.

It would be like saying that a road (economy) that becomes heavily congested (has very high gasoline prices) at 11am (when leading indicators are stronger) will be better able to deal with that congestion (avoid a recession) than a road (economy) that becomes heavily congested (has high gasoline prices) at 8am (when leading indicators are weak).

Wouldn't it be better if we could assess the future of the economy with as much clarity as congestion on the roads?

Sunday, June 10, 2007

Go fishing

Our grandparents and parents have seen a rapid increase in the cost of living throughout their lives.

But that was just the beginning. They could never have anticipated what would come next.

What was affordable to our parents is unaffordable to many of us now: buying a house, driving a car, going on holiday, even buying a cup of coffee.

What some might consider fundamental to living a 'normal' life has now gone beyond the reach of the average person.

How it became this bad has already entered the mainstream media: developing countries such as China and India have been using natural resources so intensely that it has pushed up the price of everything that developed countries use every day.

What is not often discussed is what this 'new world' will mean for the lifestyle of millions, if not billions of people all over the developed (i.e. rich) world.

***************************

As I mentiond, a rise in the cost of living is nothing new.

The process of industrialisation and technological change has improved everyone's standard of living.

But this improvement has always come at a price.

After all, any rise in the cost of living is an inevitable by-product of an improving standard of living: we all need to want more to be willing to pay and hence justify its production.

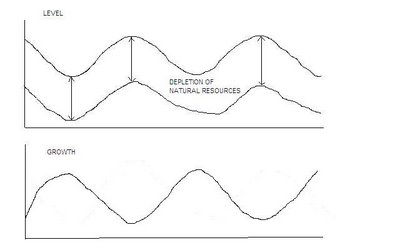

This is simple supply and demand, as illustrated in my nifty little chart below:

The price of growth

What this chart shows is the rapid and increasing cost of living seen over the past 100 years or so.

Over that time, whenever there was an improvement in the standard of living and an accompanying rise in the cost of living, there was always an increase in demand (D,D',D''' etc.) to match the increase in supply (S, S', S'' etc.).

This process has accelerated in the past 10-20 years, especially with the rise of computer technology and globalisation. Note the chart does simplify a trend (after all, there could arguably have been a fall in the cost of living line over some periods, although the trend is certainly up), but it still manages to capture the current problem: a rise in the cost of living that has created a mis-match between supply and demand.

What this means is that the current increase in the supply of goods and services has not, and will continue to not be matched by an equivalent increase in demand. (Note: this is the case for developed countries)

***************************

So, what does all this mean?

In reality, quite a lot.

Firstly, substitution.

Instead of buying houses, people will rent. Instead of driving cars, people will use public transport. Instead of going to Starbucks, people will bring a flask to work or just drink water (from the tap!).

Secondly, people will change their lifestyles.

In the chart, any increase in demand that matches the increase in supply has an associated "sacrifice" that must be made.

Once people decide that the necessary sacrifice is not justified, or affordable, they will opt for a different way to use their free time and spare cash.

One option might be to go fishing.

Thursday, May 10, 2007

An American revolution

Once completed, this transformation can only be to the benefit of everyone around the world.

Of course, the main people to benefit will be the American people themselves. Not least because changing the attitude of the American people (and the people they elect to government) will fundamentally alter the way the rest of the world perceives them.

After all, the attacks of September 11th 2001 happened exactly because of the negative way America was seen in the eyes of those who killed all those innocent people that day.

By electing leaders who look out to the world and not away from it can America have any hope of becoming a credible world leader again.

******************************

So who, you might ask, are these 'new' leaders? And why are they any different from their predecessors?

Well, firstly, they won't be Republicans.

Last week, after watching the 10 candidates from each of the Republican and Democratic parties debate on live television, it became clear who was fighting for what and who was most likely to win.

On the Republican's side, the emphasis was on the "War on Terror" (WOT) and on "bringing terrorists to justice". Noble goals no doubt but, as the war in Iraq has proven so painfully, completely futile.

Terror cannot be defeated. It just keeps coming back. (The only way you could actually defeat terrorism would be to eliminate it from the dictionary!)

On the Democrat's side, there is no WOT, only HAM ("hearts and minds") that need to be won.

This line will play very well with an American public that is sick of hearing about fighting and war and terror.

That's why the US Congress is now controlled by the Democratic party and that's what will ultimately sway the American public towards a Democratic President of the United States.

******************************

So now we know which side is likely to win, who could be sitting in the Oval Office by January 20th 2009?

A few months ago my money could have been on Barack Obama.

The 46-year old from Illinois showed a lot of promise, offering soothing words of hope to the American people. And the fact he isn't white made him (literally) stand out from the crowd!

Maybe next time?

But the more I listen to his words, the less convinced I get.

His rhetoric has turned from solving problems to falsely naming causes.

For instance, he suggests that China is taking away American jobs. Not only would this be impossible to prove, it suggests a protectionist solution that can only damage relations with the most important country in the world other than the United States. This would make for a bad President.

The alternative combination is clearer to me now than ever: John Edwards for President and Hilary Clinton for Vice President.

A winning team

It is clear because it contains the two most important elements needed in a successful candidate: success and a mandate for change.

A few years ago I predicted that Hilary Clinton would run for President. Not many people believed me, but it proved correct.

Unfortunately, while she clearly has a mandate for change (again, she sticks out a mile), she isn't likely to win over enough of the public. Change comes in steps, not giant leaps.

One step towards a female President is a female Vice President.

The President who she is most likely to serve with is John Edwards.

Most people have fresh in their minds his close defeat as Vice President nominee to Bush in 2004 and this could provide enough momentum for Edwards to carry him all the way through to a successful nomination and victory.

******************************

If you've read any of my previous comments on politics you might think this post was something of a backtrack. As a politician might say, it is and it isn't.

I still strongly believe that electing an individual to run a country is based on the outdated notion that the voting public should only decide on a major issue affecting their lives once every four years simply because this is the most practical way of running a democracy.

This is clearly not the case, with almost 70% of the US population now connected to the internet and ready to vote on an issue that is important to them.

However, as previous elections in the US and around the world have shown, electronic voting is in its infancy and prone to error.

Of course, I remain wary of any 'efforts' made to rectify these problems since it is in the interests of those currently in government to prevent electronic voting from putting them out of jobs!

Still, given there remains a more pressing need for change in the United States, a new leadership will help take the country in the right direction.

It is better to have someone at the head of government whose goals are "eliminating poverty, fighting global warming, and providing universal healthcare" than someone hell-bent on fighting a war that only innocent people will lose.

Tuesday, April 17, 2007

WIll you be my friend?

We feel it might help us to understand just a little about how someone could do something so horrific.

But you have to wonder just how much we can ever know about a "loner" and whether he was truly lonely or not.

***************************

When you ask someone how many friends they have the answer of course depends on who you ask and how old they are.

If you ask your grandparents they may have a list of people who they've known for a number of years, if not decades.

If you ask your parents, they will have a lot of people they've known either since childhood or over a number of years.

But if you were to ask me, I could show you a list of contacts on MSN, Skype, Yahoo, different email accounts and people I know through work. This doesn't even include the websites designed to reunite past shoolmates or online dating.

I literally have more friends than I can remember.

But I don't spend a lot of time going to parties , meeting for dinner or going to nightclubs. I tend to spend most of my time at home. You might even call me a bit of a "loner".

***************************

While Cho Seung-Hui will forever remain a mystery to so many people, it's too convenient to attach a label and use this to help explain his motives for doing what he did.

At best it will misrepresent the life he truly led and at worst it may prevent us from ever being able to understand what truly led him to kill so many people or help prevent it from ever happening again.

Saturday, April 14, 2007

Last ray of hope

I was close to making this decision after seeing Children of Men, but my latest experience left me no doubt in my mind.

A number of reasons have led me to this conclusion, most importantly:

1) The movie (like so many I've paid to see in the past) was rubbish (no doubt the book was better);

2) The people sitting behind me kept whispering audibly to each other and continuously kicked the back of my seat after arriving late;

3) The popcorn made me feel bloated;

4) I drank so much that I wanted to use the bathroom halfway through but didn't want to miss anything important, so sat in agony for the last 30 minutes;

5) I could enter the cinema and walk directly to my seat without anyone checking to see if I had a ticket.

The last point was the most telling of all. The fact that nobody checked to see if I had a ticket proves how pointless it is to pay for the experience in the first place!

I doubt you could ever walk into a concert or play without someone checking your ticket. After all, these are still valid forms of entertainment.

************************

My decision to stop paying to watch a movie at the cinema is of course partly explained by the fact that there two perfectly viable alternatives: waiting for a DVD release or, if you can't wait that long, downloading.

Either allows you to enjoy the movie on a widescreen TV, plasma or projector, proving a similar viewing experience with the option to eat whatever you want, whenever, without having to worry about the people behind you ruining it.

While many can argue that downloading a movie is wrong, it can now be justified on the basis that it allows you to avoid the unpleasant experience of seeing it at the cinema!

Cinemas are a relic of the past, providing a deteriorating service that has been replaced with a superior alternative at home.

It's time for these buildings to be torn down and replaced with affordable housing, just like shops on the high street, as I've argued before.

Wednesday, April 11, 2007

An inconvenient fact

Listen to what he has to say before I rip it apart piece by piece...

I know what you're thinking. Blue T-shirt?? Where's the grey hair and grey suit??? Surely he isn't a real economist, is he?!? Well, if he talks like one, the chances are, he is one. And he seems to have some older, greyer friends, which always helps.

***************************

The ideal that he and every other economist aims to achieve is a system that ensures the self-motivated actions of each individual be consistent with the interests of everyone else. A good example of this would be to charge customers for plastic bags at the supermarket so that they have an incentive to re-use old ones thereby helping them save money AND the environment.

Of course, it's easier to achieve this ideal scenario on a small scale. But when you begin to try and solve 'bigger' problems you run into obstacles that ultimately prove practically impossible to overcome.

To see this you need simply to ask: why hasn't what he suggests been done already? The answer lies in the different interests of the various groups involved.

Basically, the priorities of those with the money and resources to solve the big problems of the world are very different to those without it. In other words, rich countries want to solve their problems first.

This isn't as inappropriate as it sounds. After all, rich countries can cause far bigger problems than poorer ones who currently suffer with diseases that are relatively easy to contain. While you can limit the spread of disease, you can't limit the spread of global warming or the collapse of the global financial system.

This is why the richest nations in the world poor billions of dollars each year into trying to solve their own problems.

***************************

While it is useful to prioritise problems (or solutions) in terms of their largest short-term gain, this doesn't take full account of the potential short- (and long-) term cost of leaving other problems unsolved.

In principle it makes sense to solve the problems of poorer countries first but in practise we live in a world where solving one problem literally creates another.

Ultimately, all we can do is try and solve as many problems as possible given the resources we have available. Anything else would be aiming for the ideal and living with something far worse than it otherwise would have been.

Monday, April 09, 2007

Epilogue of a boom

If you've been investing in any stock market around the world over the past few years, you've done very nicely indeed.

Of course, if you're a long-run investor or aware that there is a business cycle (or even better, both!) then you've done very nicely over the past few decades and no doubt will continue to do so.

However, you're still only as good as your last investment. After all it can only take a few days or weeks to wipe out an entire year's worth of gains.

Now is one of those times when you really have to wonder if it's the time to sell.

I'm not saying this as an economist or as an investor, but as an observer of three simple facts.

These facts help explain why now is one of the riskiest times to be actively investing in the stock market.

***************************

Fact #1: There is a bizarre range of opinions about whether the US Federal Reserve is about to raise or cut interest rates.

Some economists believe a further hike is still a distinct possiblity while others are adamant that the next move will be down either within the next few months or at the latest by year-end.

Of course all of these economists have at some time or another been wrong about the Fed's next move(s), so their opinion (or difference of it) is not something to take too seriously.

What should be taken seriously is the prospect of the Fed actually having to cut interest rates at some point in the near future.

History is not usually the best guide for the future, especially in the stock market.

However, when it comes to the relationship between when the Fed cuts interest rates and the subsequent performance of the stock market, it's all we have.

US interest rates (red) and stock market growth (blue)

1950-1996...

... 1996-2007

As both charts show, whenever the Fed has had to cut interest rates (and even when it hasn't) the stock market has fallen sharply.

One thing we often hear about is how interest rates are "historically low". From the first chart it's clear to see how low the red line has fallen and still remains in the second. This is why some economists still believe there is further room for a further hike or two.

At the end of the day, when the Fed does start cutting, it will already be too late if you're exposed to the stock market. As the second chart shows, the stock market (blue line) falls before the Fed starts cutting in anticipation of a slowing economy.

Fact #2: There is an even more bizarre range of opinions about whether the US economy will experience a recession either this year or next.

Most (in)famously, former Fed Chairman Alan Greenspan said recently that he saw a 30% chance of a US recession in 2007. As always, his comments have helped to sharpen the debate among other economists about the probability and timing of the next recession.

Given their poor record at predicting the direction of interest rates, it's not surprising that any forecast of a recession should be treated with more skepticism than respect. If they can't predict the actions of 12 people sitting around a table (deciding the direction of interest rates) it's unlikely they can forecast the consequnces of the actions of millions of people and thousands of businesses.

But again, given the frequency of past recessions in the US (shown by the shaded red areas in the charts above), we're due one soon.

Fact #3: Nobody seems to know if the US housing market will continue to deteriorate.

The consequences of a sharp correction in the US housing market for the rest of the world are extremely severe for one simple reason: if US real estate valuations fall further, US consumers will stop spending and the world economy loses one of its engines of growth.

I say "one of" because these days China and India are also fuelling global growth at an unprecedented rate.

Still, it's US consumers who still remain the biggeset spenders out there and what they do will be as important, if not the most important, determinant of global growth for years to come.

***************************

What these three facts all have in common, is that they reflect the fact that the US economic cycle has reached the stage where a sharp slowdown is not only inevitable but likely.

While the timing of such a slowdown remains uncertain, it is likely that any investor who remains heavily exposed to equities for the next 2-3 years is unlikely to see any gains over the period.

There are two choices that remain: sell soon or sell now.

Saturday, April 07, 2007

Truth: a false frontier

But how much do we understand about this so-called 'frontier'? And when do we know we're on it? And why does it matter whether we're on the frontier or not?

Recently, while having dinner with a friend who works as an academic economist, these and other thoughts crossed my mind.

I realise now, looking back on my decision to leave academia and go and work in the private sector, that pursuing 'pathbreaking' research is no longer an option.

So where I am now relative to this frontier? Have I been getting further away from it every year since I left the academic world? And does this mean that my research is worthless?

***********************

Research is the act of collecting facts in pursuit of the truth.

The more facts gathered, the closer we get to the truth and the more we understand.

So, 'frontier' research could be considered that which gets us closest to the 'truth'.

However, there is still very little we can say we know for certain.

So, is it possible that we may never know the 'truth', but rather only get as close as possible to it?

If this is the case, then frontier research would be the only research that mattered. Anything else would be a step backwards, right?

But what if frontier research actually took us a step backwards in our understanding? What if the product of frontier research turned out to be at best misleading or at worse just plain wrong? Worse still, what if what we thought was 'wrong' was actually right, but that we couldn't identify it as 'right' because we didn't know what 'right' was!?

***********************

In reality, there is no 'right' or 'wrong'. There is simply the addition to our pre-existing understanding. Anything we didn't know before but know now is considered a contribution, or 'on the frontier'.

In reality, anyone is capable of making such a contribution, because there are an infinite amount of things we don't know. Maybe this blog just helped improve your understanding, unless you knew all this already...

**AFTERTHOUGHT**

Apparently, over 60% of academic research is the 'regurgitation' of previous work. This is worthwhile in either proving or disproving ideas and for suggesting further areas of work. Whether this is worthy of being considered 'frontier' research is of course debatable.

Thursday, April 05, 2007

Blue screen of death

Soon after it was founded in 1975, Microsoft's mission was to have "a computer on every desk and in every home, running Microsoft software".

Mission (near enough) accomplished.

So why the great disappointment?

It's not because of the infamous blue screen of death that frustrated users of Windows will see every time their system crashes.

It's because a company with more than $40 bln in revenue has failed to set itself a new mission.

This provides a lesson for companies like Google, which is currently riding the wave of success that Microsoft enjoyed over 20 year ago.

********************************

Watching the share price of a company tells you almost everything you need to know about it.

The stock of Microsoft charts both its great success and recent failures.

Going nowhere fast

Microsoft would seem to represent a typical company that has reached the "mature" stage of development, where growth is a thing of the past and its potential has already been fullfilled.

Not so fast.

Does it really make sense for a company that develops and manufactures computer software to already be past its prime when the 'information age' has only just begun?

I used to doubt it.

I thought, if Microsoft would change its mission to something like "a television in every home, running Microsoft software", then it would stand a chance.

But it never changed.

And then it was 1998 and Google arrived on the scene.

Now that it's competing with the likes of Google (not to mention Apple) it's become a lot more difficult for Microsoft to profitably branch out (e.g. Xbox flop), while preserving the core business.

********************************

Google is a company with more than $10 bln in revenue (thank you Microsoft!)

Google's mission is "to organize the world's information and make it universally accessible and useful."

Perhaps intentially, this mission is not much different to Microsoft's.

Perhaps not surprisingly, Google's share price has also taken off in a similar way to Microsoft in its early days.

Look familiar?

Everyone is very excited about Google. After all, it's a great achievement. A dissapointment sometimes perhaps (it doesn't always find what I'm looking for, but hey), but not as great a disappointment as Microsoft... yet!

If Google fails to change its mission as times change then it too will die a "blue screen of death", just like its ancestor.

Thursday, March 08, 2007

The boom that keeps on giving... and taking away

When we go shopping, the amount we pay for a loaf of bread or the cost to fill the tank of our car allows us to realise what is happening in the world around us.

In case you hadn't noticed, both of the above have been getting rather expensive lately.

This is because a booming world economy just keeps on booming.

Consequently, any decline or "popping of the bubble" can only offer temporary relief from an unprecedented increase in the cost of living that doesn't look like losing momentum any time soon.

************************

A few years ago I wrote on my blog that oil prices had risen so rapidly that it was a sure sign of a bubble.

That was in 2004, when oil prices rose from $30 per barrel to $50 within less than a year.

I expected a sharp downward correction to follow, and sure enough by the end of 2004 oil had fallen back down to $40. All well and good.

Until what happened next.

Oil prices then went on to almost double to nearly $80 within 18 months! Since then, they have fallen back down to $60.

Gyrations in the price of oil might seem like the movements you would expect to see in any financial market. But very few markets are as important as the one for oil and as difficult to predict.

************************

It has taken many years for economists to understand the impact that China, India and other developing economies have had on the rest of the developed world. In fact, this understanding remains patchy at best.

China is especially tricky.

What has now become the biggest producing nation is the least accountable. We just don't know what's going on over there.

However, what we can measure is the effect that China's economy is having on the rest of the world. In particular, through an increase in the price of commodities, most importantly oil.

Which brings us back to our loaf of bread.

The next time you see higher prices at the supermarket or read about the rising cost of living, remember that much of this increase can be attributed by what is happening elsewhere in the world, particularly in China.

Whilst countries like China are helping to keep the world economy booming, they have also left a rather large bill for the rest of us to pay.

Thursday, February 15, 2007

The third desire

While the way we consume the first two hasn't changed much over time, our way of receiving the latter has been revolutionised.

Unlike food or sleep, there is an insatiable appetite for information.

With each passing day our demand for information grows. We just can't seem to get enough of it.

Luckily, people are being more generous with information of their own (personal web-sites, blogs, online chatting, online dating, free newspapers, reports etc.)

You give a little, you get a lot.

******************************

Together with a surge in the supply of information has come the call for greater transparency.

We don't just want to have more information, we want to know information we weren't allowed to know before.

While there is no limit to the information we want, there will always be a limit to the information we are given.

This disparity has shrunk over the past quarter of a century, mainly due to the spread of the internet.

But the more things have changed, the more they have stayed the same.

Much like other freedoms we haven't done anything to earn, it's not immediately clear exactly how we should use this new information.

It's like telling a farmer in the 19th century about the internet. He wouldn't neither be able, nor know how best, to use it.

******************************

When I read about a leaked government memo or the minutes of a central bank meeting there is information contained in those reports that would never have been made available to the public 50 years ago.

It is easy to forget that the actions of our not-so-distant past generations have had such a profound effect on the way we live our lives today

It is difficult for someone who is 20 years old to understand why they are able to read something their parents' generation never had the right to do and more importantly how best to use this additional information.

Sunday, January 28, 2007

The cost of free healthcare

Having free health care at the point of entry is something envied by people around the world. (Others would need to see it to believe it!)

When you consider that almost 50 million people in the US (equivalent to almost the entire British population) don't have the necessary health insurance required to pay for medical treatment, you realise how lucky people in the UK really are.

Not surprisingly however, the NHS is constantly underfunded.

Of course by definition, if you provide a service for free, the potential demand will be infinite!

Clearly the NHS will always be underfunded.

The question will always remain, by how much and where should any additional funding be coming from?

The answer goes to the very heart of the issue of how the political system currently works.

********************************

As a way to move the NHS forwards, the British government has recently imposed a series of 'targets' to help ensure an improving service is being provided to all patients.

The result has been enormous pressure being placed on staff and management to achieve these targets in order to 'stay in business'.

Overall, there have been improvements but even though targets are a good idea, what the NHS really needs now is more money.

The problems of more expensive technology, an ageing population and higher expectations are not going to be solved by setting targets alone. Someone has to pay for this and that someone is...

... You!

But at the moment no political party has the incentive to raise taxes to pay for improved public services. Why?

Because people don't want to pay higher taxes for improved public services.

Consider that statement for a moment...

People... don't want... to pay... higher taxes... for improved public services.

First, ask yourself if you agree with the premise of this argument? Second, are you one of those people?

I believe your answers to each of these questions are most likely to be 'yes' and 'probably not'.

********************************

The current state of British (and any other) politics is to essentially offer the choice of either higher or lower taxes.

This puts the voter in a conveniently awkward situation: they can vote for lower taxes, knowing they will be better off, at the expense of others.

What's worse, the decreasing voter turnout in British elections means that 40% of the British popualation (myself included) never get their voices heard.

Is it really fair for 30% of the population to be represented by people offering the false hope of a 'low tax' economy, when this leads to the situation of a increasingly underfunded NHS?

Once the 40% silent minority becomes 51%, it will signal a time for change in British politics. Maybe this could usher in a new generation of politics that stands for what people truly want.

Monday, January 08, 2007

Economists have learnt to subtract

Growth in home prices, growth in consumer spending, growth in the economy etc.

The basic question they are paid to answer is: "how are we doing compared to last year?"

But isn't looking at growth of data like GDP going to miss the damaging effects of global warming and the depletion of natural resources?

Not really. Unless there's likely to be a major change in the rate of depletion over the next 12 months (the economist's usual time horizon).

*****************************

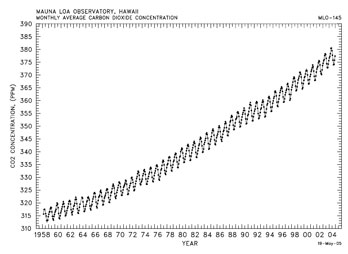

As highlighted in the movie An Inconvenient Truth, the monthly average carbon dioxide concentration has been steadily rising for over half a century.

Note the level of CO2 has been rising steadily, not at an increasing rate.

Going up

If we use this chart as a some kind of benchmark for the destruction of natural resources, we might conclude that until now, this destruction has occured at a constant rate.

So what is the incentive for economists to "factor in" the effects of depleting natural resources if their main concern is the growth rate of the global economy over the next 12 months?

Not very high.

Spot the difference

It's not that economists don't care about the depletion of natural resources. It's just not their job.

Central banks and governments can barely keep their own economies under control for a year, let alone limit the emission of CO2.

Of course, once the depletion of natural resouces starts to have a material effect on major cities (by drowning them), then economists will start to be concerned, but only if it cuts the growth rate of GDP!

Monday, January 01, 2007

Paris: a higher calorie Tokyo

And now I know why.

So many details of Paris are replicated in Tokyo, only with a (sometimes not so) slight improvement.

Below are a some examples:

-- Tokyo's underground is designed similarly to Paris, only much more modern; there is no English version for the French announcer, no information about where you can change at the next station;

-- Tokyo's 'Champs Elysees' is smaller, so made to look more exclusive;

-- Japanese people are as proud of their culture, only less arrogant!;

-- Japanese food is just as tasty, only much healthier!

To visit Paris you understand what inspired many of the details you find in Tokyo.

So if you ever decide to visit Tokyo, visit Paris first.