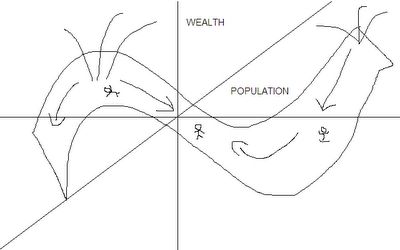

These non-mythical creatures are supposedly helping to fuel world economic growth.

But who are they? What are they?

They're wealthy.

**************************

You might think you've seen a USC walking around the streets of America.

But a lot of these people look quite poor; surely they aren't the USC's you read about...

They aren't.

They're poor.

The USC's you've heard about are probably doing their shopping from home, on the internet.

Sharing the American pie

The fact is over two-thirds of the US population is doing quite nicely.

They probably have a good job and live in a nice home.

In the past these USC's have caved in to the pressures of standing to lose both.

These days they only have to worry about one of those problems, if at all.

**************************

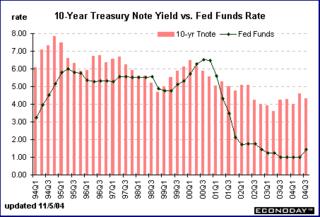

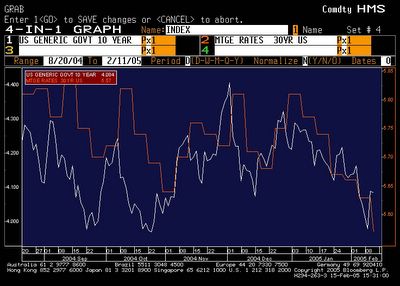

Unusually low real interest rates in the US over the past few years (see next piece) have put USC's minds at rest.

They can sleep easily in their beds and shop happily on their computers.

The Federal Reserve has been studying these USC's for a while now and knows exactly what they need to do in order to save them from extinction.

Spending begins at home

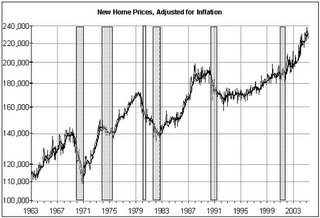

The chart above shows US home prices over the past 50 years. The shaded ares are recessions.

For the first time over that period home prices have continued to grow while the economy shrank.

Why?

Negative real interest rates.

People have been able to borrow money at such a low rate of interest that makes it look like a sure bet.

While there's no free lunch, the bill doesn't necessarily have to come at the end of the meal.

The cost of buying a home isn't fully realized until it's finally paid off.

This depends on what happens to interest rates.

At the moment interest rates are still low and look likely to remain so.

**************************

Gradually rising interest rates won't hurt USC's.

Rapidly rising rates will.

The Fed knows this.

It will do everything in it's power to prevent it from shooting itself and USC's in the foot.

Go USC!