Once he replaces Alan Greenspan next year, it's uphill all the way. Or should I say downhill...

Until now the U.S. Federal Reserve has been raising interest rates in an attempt to regain 'neutral' ground.

Near-zero interest rates were a recipe for disaster (i.e. Japan) so there was only one way interest could go.

Unfortunately, they haven't gone there quick enough.

**********************

Under Alan Greenspan's tentative guidance, the Fed looks like a driver lost in the dark. It knows it has somewhere to go, but it doesn't know exactly how to get there. So it takes it one small step at a time.

One problem with this is the ferrari behind (the bond market) is in a hurry to get where it wants to go!

The Fed is supposed to act as the "guiding light" for the bond market, dictating the future trend of interest rates.

Lately, the Fed has been a poor guide; the ferrari is ready to go it alone.

**********************

It's important not to forget how far the Fed has come.

As U.S. politicians continuously remind the public, interest rates are still at a 40-year low. And they got there pretty fast.

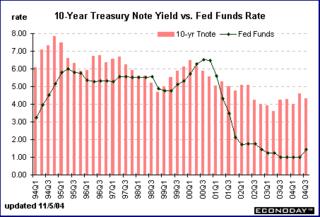

The black line indicates the Federal Reserve's overnight interest rate. The red bars are the interest rates on 10-year Treasuries. The Fed sure seemed to know where it was going 2 years ago!

When the Fed set out in a new direction at the end of 2004, the reasons weren't clearly laid out. The only clear fact was that interest rates were too low. The light, it assured the market, was at the end of the tunnel.

The ferrari didn't buy it.

Over the past year the Fed has lost credibility with the public and with the market (something that can only be earned through transparency , a point I made before the Fed started raising interest rates).

The market continues to buy bonds and the public continues to borrow money and purchase homes. The Fed should take a lot of credit for this (no pun intended).

**********************

When Alan Greenspan labelled the continuted fall in bond market yields this year a conundrum, it was like a driver scambling to find his current place on the map.

Unfortunately, it's too late for him to do anything about it, other than just vent.

With Bernanke at the wheel, the Fed may regain some credibility with the market and perhaps start leading the way.