I'm back to explain why again and also predict what will happen to U.S. interest rates after Alan Greenspan retires from the best job on earth.

********************

In case you hadn't already noticed it's daily movements in the bond market that actually determine the mortgage rates your bank offers you on a daily basis.

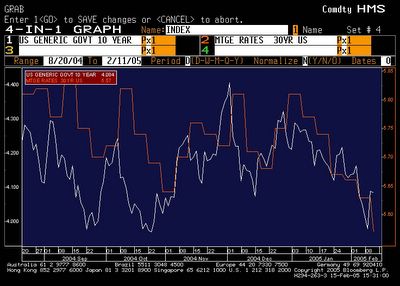

If you don't believe me, look at the chart below that shows the 10-year government bond yield (set by the bond market every day) against the 30-year mortgage rate (set by the banks every day).

(Red: 30-year mortgage rate. White: 10-year bond yield)

Most people might think it's the central bank who directly (or even indirectly) set mortgage rates, with retail banks following suit. This isn't how it works.

Firstly, central banks only change interest rates on a monthly basis, if at all. However, banks change the rates they offer to lenders all the time. You might wonder how they can do this if the central bank hasn't changed the "interest rate".

The reason is simple: banks settle their books at the end of every working day by borrowing money at a rate of interest that is being set by the bond market. The bond market sets the interest rate according to expectations of future inflation.

If inflation is expected to increase then interest rates will have to rise in order to compensate bondholders who will see the value of their investment fall in real terms.

********************

As I also mentioned before, the past 2 decades has seen a major crackdown on inflation. This has meant lower interest rates across many countries.

The U.S. is one of the few countries that does not directly target the inflation rate, simply because the person in charge of monetary policy does not want to use a target.

Since Alan Greenspan is expected to leave his post in the near future this raises the possibility that the Federal Reserve will adopt an inflation target as well. This will be very good news for the bond market and more importantly, great news for mortgage holders.

An inflation target means the bond market expects low inflation. Low inflation expectations means low bond market yields. Low bond market yields means low overnight interest rates and this means low mortgage rates.

3 cheers for Alan Greenspan. More cheers for the inflation target!

3 comments:

Easy Al Greenspan is a thief, a legal counterfeiter. He has been expanding the money supply at a prodigious rate, trying to stop the stock, bond, and housing markets from collapsing. The rate of interest on savings accounts is well below the rate of price inflation. In so doing, Greenspan is STEALING from everybody who has previously saved money, and he is stealing more from those who have saved more.

With the amount of money Greenspan has stolen, he deserves no less than the death penalty.

There is a new lower spot in hell. They have excavated, and prepared a new lower spot. Those that occupy the lowest spot are no longer the lawyers and politicians; the central bankers are even more evil.

Faced with a slowing economy and low inflation expectations, the Fed was left with little choice but to flood the system with easy money. If they hadn't it would have been seen as repeating the mistakes the Bank of Japan made in the past.

People have gotten so used to the reassuring words of Alan Greenspan that one wonders if there is somone who can speak with such alacrity without spooking the markets. Truly they are a dying breed...

Some people read too much Krugman for their own good... :)

Post a Comment