2006 will bring the last few scenes of the US Federal Reserve's Comedy of Hikes.

Will a new hero step in to save the day or will he arrive too late?

Time's up.

********************

The bond market is literally bending over backwards to get the Fed's attention.

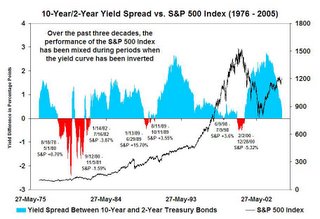

The yield curve is inverted.

This means that investing in a government bond for 2 years earns you a higher rate of interest than investing for 10 years.

Strange, huh?

Yes.

Not funny

Before the yield curve inverted, the Fed relentlessly increased interest rates at a painfully slow rate. A quarter point here, a quarter point there.

No end was in sight.

But as is becoming commonplace in today's damn the future society, the light at the end of the tunnel was a truck heading straight for us.

It won't be easy to turn around in time and avoid the crash.

As the chart shows, when the yield curve has inverted, the stock market gets edgy.

What's worse, the economy either contracts or slows considerably.

********************

Either a recession or a slowdown of the US economy now look inevitable. The latter much more than the former.

Of course, if that truck were to be carrying a load of explosives we might be in for even more trouble!

(English translation: the US economy is now more vulnerable to a recession following a terrorist attack than at any time since 2001).

No comments:

Post a Comment