Not when the chairman of the Federal Reserve is talking.

If he's concerned then financial markets are concerned.

If markets are concerned, then you pay the price.

What did I say?

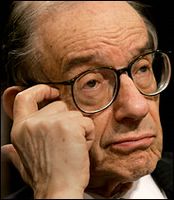

This morning, Alan Greenspan told congress:

"The federal budget is on an unsustainable path, in which large deficits result in rising interest rates."

So, "unless major deficit-reducing actions are taken" interest rates are more likely to go up than down.

Investors got nervous, thinking this might actually signal higher interest rates (since the person talking sets the target for the overnight interest rate). They sold bonds, pushing yields higher.

As I have discussed before the bond market is what essentially sets mortgage rates. If bond yields go up then your mortgage bill goes higher too.

****************************

It's important to remember that for policymakers, words are just as important as actions. Anything they say can be taken to imply something they may do.

Markets are always thinking about the future.

If you think like the market thinks, you can avoid getting hurt by it every single day.

No comments:

Post a Comment